One year ago, in our August 2021 Risk Update https://convex-strategies.com/2021/09/22/risk-update-august-2021/, we laid out how we look at the world through the prism of Self-Organized Criticality. That note is undoubtedly one of our most popular Updates and one that we always refer people to when they would like to understand our philosophical mindset.

In that Update, which we humbly recommend you read if you have not already, we compared President Biden’s July 2021 speech (https://www.whitehouse.gov/briefing-room/speeches-remarks/2021/07/08/remarks-by-president-biden-on-the-drawdown-of-u-s-forces-in-afghanistan/), regarding the end of the Afghanistan war and pending full withdrawal of military troops, to Fed Chair Powell’s August 2021 Jackson Hole speech (https://www.federalreserve.gov/newsevents/speech/files/powell20210827a.pdf). We said this at the time:

“Now to Chair Powell’s Jackson Hole August 2021 speech, which we find remarkably similar in structure, from an SOC perspective, to President Biden’s July 2021 Afghanistan speech, except that Powell isn’t yet getting around to withdrawing the troops.”

Chair Powell went to great lengths, as we discussed in the Update, to explain away concerns there might be around the potential unintended consequences of losing control of their price stability measure (aka “inflation”). Our response at the time to the pushback as to why central banks would ever let interest rates go higher was the now seemingly profound “presumably because they decided to”.

It is now a year later and the great and the mighty were once again gathered back in Jackson Hole. This time Chair Powell focused singularly on withdrawing the troops. The August 2022 speech (https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm), scaled down from some 20-pages in 2021 to a mere 4-pages this year, got straight to the point:

“Without price stability, the economy does not work for anyone.” Jerome Powell, August 2022.

This echoes very familiar with our own quote, at the time offering it as advise to the ECB in our May 2022 Update (https://convex-strategies.com/2022/06/22/risk-update-may-2022/) – “We would proffer for the ECB, should they care to consider, that without price stability there can be no stability.”

We have updated some of the charts that we used last year when rolling our eyes at Chair Powell’s then attempt to brush aside inflation concerns. As he put it, “that concern is tempered by a number of factors that suggest that these elevated readings are likely to prove temporary.”

Chair Powell tried to make the case that, if you eliminated those things that were showing particularly robust price increases (eg. durable goods) at the time or used trimmed mean measures (in particular his chosen Dallas Trimmed Mean), then things weren’t all that far away from their 2% objective. We pointed out that other commonly used trimmed mean measures (eg. Cleveland Trimmed Mean) might indicate otherwise. A year later, whether you focus on Dallas or Cleveland, it doesn’t matter much which you chose, it has been a one-way street since.

Figure 1: Federal Reserve Trimmed Mean Inflation: Cleveland (white) Dallas (blue). August 2021 (red)

Source: Bloomberg

Chair Powell further noted back in 2021 that “we see little evidence of wage increases that might threaten excessive inflation.” He showed the chart of two wage measures.

Figure 2: Atlanta Fed Wage Growth Tracker (white) and ECI yoy% (blue). August 2021 (red)

Source: Bloomberg

We noted at the time, in response to his comment that “wage increases are essential to support a rising standard of living and are generally, of course, a welcome development”, that he should probably have rephrased that particular statement to focus on “real wages” and posted the below, now updated to show the ongoing issue.

Figure 3: US Real Average Weekly Earnings yoy%

Source: Bloomberg

Chair Powell, finally, made the point that global disinflationary forces had been persistent for advanced economies going back to the 1990s. “While the underlying global disinflationary factors are likely to evolve over time, there is little reason to think that they have suddenly reversed or abated.” We would bet that he wishes he could take that one back! We showed UK CPI and Eurozone HICP as indicators even then that phase transition was likely afoot.

Figure 4: Eurozone HICP (white) and UK CPI (blue) yoy%. August 2021 (red)

Source: Bloomberg

Chair Powell was slow to get there, but his August 2022 Jackson Hole speech dropped all the propagandist charts and word-play spin. “Our responsibility to deliver price stability is unconditional.” Late to the game, but good to hear.

History shows us that to get the job done the Fed has always had to take the Fed Funds Rate above the common measures of price stability. We have quoted Arthur Burns several times before:

“In principle, no matter how high the nominal interest rate may be, as long as it stays below or only slightly above the inflation rate, it very likely will have perverse effects on the economy; that is, it will run up costs of doing business but do little or nothing to restrain over-all spending……In many countries, however, these rates have at times in recent years been so clearly below the ongoing inflation rate that one can hardly escape the impression that, however high or outrageous the nominal rates may appear to observers accustomed to judging them by a historical yardstick, they have utterly failed to accomplish the restraint that central bankers sought to achieve.”

Figure 5: US CPI (white) and PCE Deflator (blue) yoy% vs Fed Funds Rate (papaya)

Source: Bloomberg

Is Chair Powell ready and willing to get to positive real policy rates?

Is the ECB? They just announced a truly unprecedented 75bp policy rate hike, taking their Deposit Rate to 0.75% in the face of a 9.1% report of annual change on their HICP inflation measure for August.

Figure 6: Eurozone HICP yoy% (white) vs ECB Deposit Rate (papaya)

Source: Bloomberg

Will “tightening” to a negative real policy rate of circa -8% be enough to return their inflation measure to their 2% target? Whoever makes up their quarterly projections apparently thinks so. Of course, they thought so all along, with or without policy adjustments.

https://www.ecb.europa.eu/pub/projections/html/ecb.projections202209_ecbstaff~3eafaaee1a.en.html

Figure 7: Eurozone HICP yoy% (blue) vs ECB quarterly forecasts through September 2022

Source: Convex Strategies, Bloomberg

Just for some perspective, a year ago in their September 2021 projections, the ECB visionaries forecast Q3 2022 HICP to register 1.4%. As of last week, they have revised that Q3 2022 projection to 9.1%. A revision of +7.70%, and recent trends would suggest that the 9.1% forecast is probably undershooting the actual numbers to come.

We can’t resist noting, yet again, ECB President Lagarde’s comments when their September 2021 projections were challenged.

“We really looked and very deeply tested our analysis of the drivers of inflation, and we are confident that our anticipation and our analysis is actually correct.” Christine Lagarde, October 2021.

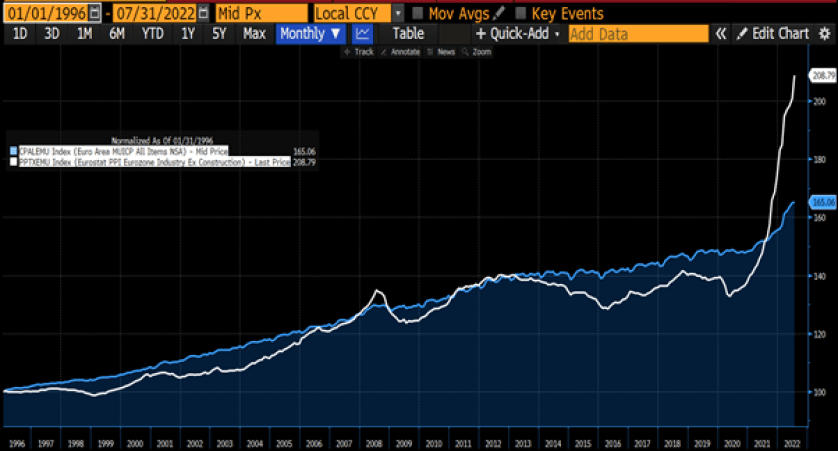

As we stress over and over again, in the non-ergodic world of economics and finance, history matters. Further, in the world of risk management, it is magnitude/scale/impact that should be focused on, not frequency/expectations. Our familiar chart of the compounded indices of Eurozone PPI and HICP give the clear implications of mistakes of magnitude.

Figure 8: Eurozone PPI (white) and HICP (blue) Indices

Source: Bloomberg

There is a reason, for all the years that central banks have practiced the art of inflation targeting up until the advent of such idiocy as Average Inflation Targeting, why the inflation level was seen as a ceiling. The risk is skewed to the upside – so brilliantly laid out in Section II of this BIS piece we highlighted last month: https://www.bis.org/publ/arpdf/ar2022e.pdf

Central banks are enthusiastic experts at saving the day when their measures of inflation dip too low for their liking. They have no hesitation slashing policy rates in large and immediate chunks, accelerating towards negative real rates, zero and even negative nominal rates. There is no need to wait around for regularly scheduled policy meetings to announce immediate ramp-ups in the scale and breadth of asset purchases. No need for signalling and preparing the market. They have no qualms venturing forth with multi-year forward guidance assuring longevity of extreme accommodation policy settings. They love being seen as the saviours.

On the other hand, when their inflation measures surge above their target (what was previously a ceiling), they are notably reluctant to engage in the equivalent tightening. As we have seen for the last 2 years, they do not immediately respond by pulling back the previous extreme accommodation. There isn’t the equivalent immediate jump to positive real rates. There aren’t any interim meeting policy changes. They undertake lengthy periods of signalling, preparing the market for changes to come months and months down the road. They taper ever so slowly their asset purchases. They engage eventual policy rate increases in the smallest possible, long-drawn-out step by step hikes. Through it all they hear constant criticism of “policy errors” due to their pending tightening.

Central bankers, no more than anybody else, do not want to be seen as the baddies. Fighting against too high inflation entails slowing things down, increasing unemployment, imposing higher borrowing costs, deflating asset bubbles. All pretty unpopular things. As Arthur Burns and his global peers learned in the 1970s, it is not an easy battle to win. This is why the intention, historically, was to prevent it in the first place. In the era of inflation targeting central banks, this was the whole point! As we quoted Ben Franklin back in our December 2021 Update, “an ounce of prevention is worth a pound of cure”.

Realistically, how is the ECB going to “cure” the path dependent nature of the above PPI index? How do they get that back to something in line with reasonable price stability? The policy mistakes have accumulated over a long period of time. It is, using the jargon of Self-Organized Criticality, in a critical state.

The one obvious player that is still holding out with max-accommodative policy settings is, of course, the Bank of Japan (BOJ). They continue to stick with their all-time extreme setting of an unlimited, every day, forever commitment to buy 10yr JGBs at 0.25%. Meanwhile, their below measures of PPI and CPI, like many of their global peers, have shifted to the high end of historical ranges.

Figure 9: Japan PPI (white), Japan CPI (blue), Japan 10yr JGB yield (papaya)

Source: Bloomberg

Their commitment to continue with Yield Curve Control (YCC) has had the ongoing effect of weakening the JPY and building pressure in the interest rate swap and swaption markets.

Figure 10: USD/JPY spot FX (white), 10yr JGB (papaya), JPY 10yr Swap (purple), YCC ceiling (red)

Source: Bloomberg

We get the chance to regularly engage with defenders of the BOJ’s policy stance. Their argument is that they need to keep going until their chosen measure of inflation is sustainably above their 2% (random) target. It isn’t too hard to get the supporters of the policy setting to then concede that the intent of the current set of policies is to expand inflation with a pretty direct channel for doing so being import prices via the weaker JPY. The question we always ask at this point is what are their plans if their policy measures work? What are they going to do with YCC if CPI gets to 3%, 3.5%, 4% and $/JPY gets to 150, 160, 170? Are they going to let the pressure continue to build and then let it go when their settings are even more out of line with circumstances? This is where, pretty much without fail, we get given the very reputable argument about why their policy measures absolutely will not work. This leads us to the obvious follow up question – in that case, why do you keep doing them?

The honest answer is that they can’t allow rates to go up. The system is too fragile: a classic sandpile. BOJ Governor Kuroda’s term ends in March next year. Somewhere between now and then, they will have to choose and announce his successor. Will the successor quietly step into the role of being the person that oversees the inevitable phase transition? Or will that person insist that the outgoing governor be the one to step away from the permanent propping up of the sandpile and allow the avalanche to find an equilibrium state? We shall see.

We wrote at length last month on what we coined as “the pointlessness of forecasting”. It seems we have touched on a popular topic as we have come across a couple of recent like-minded notes. One by famed historian Niall Ferguson and the other by legendary investor Howard Marks.

https://www.oaktreecapital.com/docs/default-source/memos/illusion-of-knowledge.pdf?sfvrsn=86034e66_5

These are both excellent notes and well worth full reads. Both align very much with our own July 2022 Update https://convex-strategies.com/2022/08/16/risk-update-july-2022/. Marks attributes an excellent quote to G.K. Chesterton:

“The real trouble with this world of ours is not that it is an unreasonable world, nor even that it is a reasonable one. The commonest kind of trouble is that it is nearly reasonable, but not quite. Life is not an illogicality; yet it is a trap for logicians. It looks just a little more mathematical and regular than it is; its exactitude is obvious, but its inexactitude is hidden; its wildness lies in wait.”

We concur. As Nassim Taleb says, “If you can predict it, it won’t hurt you. If it will hurt you, you can’t predict it”. The models look like they work well enough most of the time. The problem is, they don’t work when it matters. We suspect the wise Mr. Marks and Mr. Ferguson would quickly appreciate our Football Pitch with the Gaussian Distribution and Shannon’s Entropy Curve overlays.

Figure 11: Participate and Protect leads to better compounded returns

Source: Convex Strategies

If you are an investment manager, build your portfolio with an emphasis on what you don’t know, not what you think you do know. Central bankers should operate the same way, protect against what hurts, don’t gamble on what you expect.

In the football analogy, it is what happens inside the two penalty boxes that by and large drives the outcome of the match. Hire good goalkeepers and put more strikers on the pitch. In our race car analogy, get really good brakes so you can, safely, drive faster. Over and over again we say it; “it’s just math”. Compounding is driven by magnitude, not frequency. Expected outcomes hardly matter.

We hear it all the time in recent months, that the industry standard for risk management (really risk reduction), the good old 60/40 portfolio, is struggling. The truth is, even through its supposed glory years, it was never the right solution. Don’t give away upside to “probabilistically” protect the downside. Explicitly protect the downside, so that you can participate in more of the upside. That is true risk mitigation. We show it any number of ways. Here is our Always Good Weather (AGW) portfolio of 40% S&P, 40% NDX, and 40% CBOE Long Vol, a Barbell Racer, versus the old standard 60% S&P and 40% Fixed Income Balanced Racer.

Figure 12: Barbell AGW (blue) vs Balanced 60/40 (red). Scattergram and Return Skew. March’09-August’22

Source: Convex Strategies, Bloomberg

Figure 13: Barbell AGW (blue) vs Balanced 60/40 (red). Compounded lines. March’09-August’22

Source: Convex Strategies, Bloomberg

We find ourselves engaged on a daily basis in discussions about what can be done to replace the now discredited portfolio benefit of the fixed income component of the heretofore 60/40 Holy Grail. The world at large is quite actively trying to figure out what alternatives exist that can protect their equity/growth allocations. In the course of these sorts of discussions, some of which occur in public at conference events that we might participate in, we always like to pose the question that, while recognizing the obvious concerns about protecting the 60, has anybody thought about what the world at large is going to do with the accumulated 40 that nobody wants any longer? Worth thinking about……

Read our Disclaimer by clicking here