Once upon a time (Feb 2010), in a world far far away (Singapore), there was a story of a conversation with a renowned former Wall Street economist turned senior monetary policy official. Said official, along with other of his colleagues, had spread out to travel the world to prepare key financial market centres around the globe for an annual upcoming presentation from his superior to the political body that ostensibly provides oversight to their activities (Humphrey Hawkins). The purpose of the long travel from Liberty Street in downtown New York City to the other side of the world was to lay out the upcoming presentation to major market participants so as not to shock markets. The substance of the speech that was to be given in the halls of Congress was in essence: “How we will exit extraordinary monetary policy measures”.

[https://www.federalreserve.gov/newsevents/testimony/bernanke20100210a.htm; https://www.wsj.com/articles/SB10001424052748704140104575057160496102900]

After a well scripted outline of what would be laid out in the upcoming speech, there were ever greater frowns and head shaking by the small and exclusive audience. Asset markets had been performing very poorly for the previous couple of weeks, and talk of just this sort of commentary had started to spread. Just as it seemed as if clouds would darken the usually endless tropical sunlight, the esteemed policymaker from across the world then assured the gathered financial titans not to worry because “they were not actually going to exit”. The gathered representatives of major financial behemoths breathed an enormous sigh of relief. Then, adding another burst of fresh sunlight to the room, he explained that he and his colleagues in other mystical lands (Tokyo and Shanghai), at the very same moment, were out telling key market participants to “keep taking risk!”. This practically had the titans on their feet. An exuberant Q&A discussion commenced, where all were assured that the authorities had thoroughly tamed the beast and it would forever heel to their commands.

Figure 1: SPX 2009-2011 4 February 2010 highlighted

Source: Bloomberg

As enthusiastic questions about how far (doesn’t matter) and how long (indefinitely) started to wind down it is told that one curmudgeonly attendee asked the visiting dignitary a question off line with the presentation thus far. The question was something totally out of left field along the lines of – “From an economic perspective, other than asset inflation, what do you expect to achieve with these ongoing endless extraordinary monetary measures, and what do you think might be the future negative externalities (he used the fancy term for unexpected side-effects to give the impression that he too had been groomed in the fine arts of economics). The esteemed visiting Economist responded with a detailed response along the lines of “I don’t understand your premise.”

The curmudgeon explained his premise, something to do with global imbalances and linkages to the global reserve currency and the likely outcome of a flow through of the extreme monetary policies of the global reserve currency to the policies of the countries on the other side of his imbalances. Then an extraordinary leap was made to proclaim that policies that would drive credit creation, asset inflation, broad inflation would likely result in an adverse (though maybe not unintentional) side effect of wealth redistribution upwards. Despite the curmudgeon’s inability to produce a mathematical model onsite, the PHD annointed economist was willing to suspend disbelief and, for the sake of discussion, allow the premise that inflating asset prices might benefit the owners of assets.

There is a longer version of this fable should anybody every want to hear it, but we will skip to the relevant portion for this version. The curmudgeon then suggested that history was dotted with more than just the occasional episode where inflationary driven extremes in wealth segregation had led to social and political instability and even conflict. Our PHD, obviously far too busy with his stochastic models to pay attention in history class, claimed no familiarity with this issue. The curmudgeon droned on, suggesting that in places with large centres of poverty, where there was already stark wealth segregation and limited political flexibility, there may be the unexpected long term consequence of even civil uprising. He even proposed examples of some countries in the Middle East and North Africa.

By now the distinguished visitor had tired of conversation straying away from Philips Curves and the like, so he proclaimed that even if their policies drove inflation and wealth segregating instability into the developing world, as long as it didn’t feedback to impact the US economy, it wasn’t a concern for them. Then the lowly, lucky to be invited, curmudgeon suggested that if ever the problem spread to some place like Pakistan and India, and triggered a conflict across a still disputed border between two very large, nuclear capable adversaries, there was some possibility that people back home might have some concern.

Figure 2: KSE100 Karachi Equity Index 4 February 2010 to present

Source: Bloomberg

And then, nine years later, after outbursts of civil unrest and war across North Africa and the Middle East (aka the Arab Spring) over preceding years, this happened –

“India and Pakistan on the Brink”

“This is Where Nuclear Exchange is Most Likely.”

Your friendly curmudgeon cannot claim to see the future, but the ongoing accumulation of endogenous risk/fragility (piles of dry brush) have a certain inevitability/natural tendency of finding a way of reducing their critically unstable interconnectivity (the dry brush catches on fire). Of course, you are all well aware of this concept, known in physics world as Self Organised Criticality, or Sand-Pile Theory. The curmudgeon could merely imagine that relentless expansion of wealth segregation, throughout centres of poverty and limited political flexibility, might someday become fragile. In fact, it might cause fragility issues the world over. At some point, the PHDs might build a mathematical model.

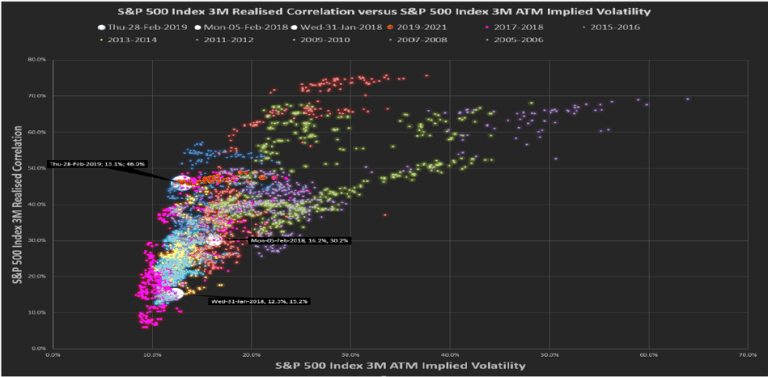

Figure 3: SPX Vol/Corr Comet

Source: City Financial, data from J.P. Morgan.

Figure 4: SGDJPY cyclical/seasonal indicator

Source: Bloomberg

Read our Disclaimer by clicking here